The Definitive Guide to Automated Insurance Solutions

The Definitive Guide to Automated Insurance Solutions

Blog Article

With regards to protecting what matters most in life, there’s no greater way than to protected oneself with the appropriate insurance plan solutions. Whether you are a homeowner, a little organization proprietor, or just a person seeking to remain ready for the sudden, the correct protection can offer assurance in ways in which transcend The standard Expense factors. But navigating the extensive environment of insurance coverage may be a frightening process. With a lot of options, how Did you know which insurance remedies are best for you?

1st off, being familiar with coverage is vital. At its core, insurance coverage is about taking care of risk. When you buy a policy, you're transferring the economical risk of a potential loss to your insurer. As an example, if you buy home insurance policies, the insurance company covers the price of repairs in case of damage to your residence. Insurance policies solutions help mitigate monetary hardships and supply a safety Internet in the event points go Mistaken, so you are not remaining inside of a complicated condition when everyday living throws you a curveball.

What Does Long-Term Insurance Solutions Mean?

Now, let us mention the differing types of insurance policy methods offered. You might have heard of The essential types—daily life insurance, well being insurance coverage, auto insurance coverage—but there’s much more for the insurance landscape than meets the attention. Homeowners insurance coverage, for instance, addresses damage to your house from natural disasters or mishaps. Company insurance policies can help safeguard businesses from liability and fiscal losses, although renters coverage handles the non-public property you own in the rented Area.

Now, let us mention the differing types of insurance policy methods offered. You might have heard of The essential types—daily life insurance, well being insurance coverage, auto insurance coverage—but there’s much more for the insurance landscape than meets the attention. Homeowners insurance coverage, for instance, addresses damage to your house from natural disasters or mishaps. Company insurance policies can help safeguard businesses from liability and fiscal losses, although renters coverage handles the non-public property you own in the rented Area.The fantastic thing about insurance answers is that they come in all sizes and shapes. All people's demands are distinct, and the best Option for 1 human being may not be the very best for another. It’s imperative that you tailor your insurance plan coverage towards your distinctive problem. Do you have a loved ones? Lifestyle insurance could possibly be a priority to suit your needs. Individual a vehicle? Auto insurance policies is critical. A business operator? You’ll want complete coverage that shields your organization’s property and employees.

In today’s world, digital remedies are transforming the insurance policy marketplace. Absent are the times of relying solely on in-particular person consultations with insurance coverage agents. With just a couple clicks, you could Look at guidelines, get offers, and buy coverage—all on line. This comfort has built insurance plan answers much more obtainable than in the past right before. But when it’s straightforward to invest in insurance policies on-line, It is really crucial to complete your homework to make sure that the procedures you are deciding on are the correct match for your requirements.

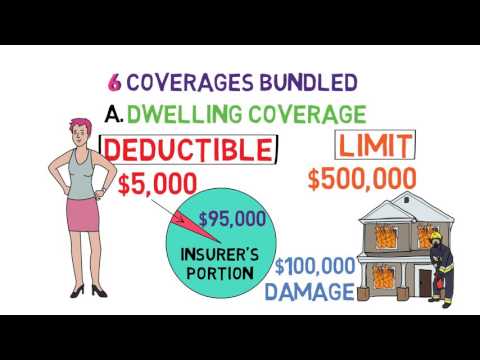

Picking out the appropriate insurance coverage remedies can often experience too much to handle, specially when there are numerous solutions to take into consideration. That’s why it’s important to take your time and effort and talk to thoughts. What’s covered? What’s excluded? What’s the deductible? These are typically some of the vital areas to explore. By remaining proactive and inquiring the correct questions, you may be sure that you’re getting the greatest security for your hard earned money.

A different critical element of insurance policy solutions is customization. Most guidelines permit you to add optional coverages or regulate the boundaries of one's protection according to your needs. Such as, with automobile insurance, you'll be able to insert roadside guidance or collision coverage for included protection. Or, with wellness insurance policies, you are able to go for a better deductible to lessen your regular monthly rates. The main element is to uncover the ideal harmony amongst affordability and enough safety.

On the subject of insurance policies answers, it’s also worthy of looking at bundling your insurance policies. Quite a few insurers provide savings when you buy various guidelines from them. By way of example, you could possibly get a much better deal if you mix your house and car insurance coverage. Bundling policies not merely assists preserve you cash but additionally simplifies managing your protection, as every little thing is beneath one roof. As well as, it’s lots a lot easier to remember one renewal date than to juggle many.

Rumored Buzz on Insurance Coverage Plans

Talking of saving cash, let’s take a look at the role of deductibles. A deductible is the quantity you need to shell out out of pocket before your insurance provider starts masking expenses. Commonly, the higher the deductible, the lessen the premium. Nonetheless, Insurance Plans for Families it’s necessary to find a stability here way too. Although picking a substantial deductible may lower your regular high quality, you may need in order that you may pay for to pay for that amount if You should make a assert.Some insurance plan solutions also supply added perks and providers. By way of example, lifestyle insurance policy policies could include dwelling Added benefits that enable policyholders to obtain a part of their Loss of life benefit if they are diagnosed having a terminal illness. Several wellness insurance programs consist of cost-free preventative treatment or supply wellness systems to stimulate healthful residing. When buying insurance coverage, it’s crucial that you concentrate on these included Positive aspects and whether or not they align with your needs.

Knowing the claims system is yet another critical Portion of picking out the proper insurance coverage options. During the regrettable celebration that you should file a assert, the procedure should be as clean and easy as is possible. Preferably, an insurance provider will likely have a simple and obvious course of action which makes it straightforward that you should report an incident, submit documentation, and observe the development of your respective claim. From the age of technological know-how, quite a few insurance policies businesses have streamlined the method with consumer-friendly applications and online portals.

It’s also worthy of noting that the top insurance coverage alternatives are people who Find out more evolve with the existence adjustments. Lifestyle doesn’t remain a similar, and also your insurance plan needs may alter while you become old, start a relatives, or grow your enterprise. Such as, if you have married or have young children, you may have to update your life insurance policies or overall health insurance policies policies to accommodate your new situation. Remaining on top of these changes ensures that You usually have the appropriate security set up.

When choosing the suitable protection is vital, it’s also important to evaluate your procedures frequently. Insurance policy companies can change their terms and costs, and new coverage possibilities may well turn out to be readily available. By examining your guidelines annually or immediately after important existence situations, you could be certain that Full story you’re not overpaying or missing out on better coverage. If you're not absolutely sure no matter if your present procedures are the best for your requirements, it's well worth consulting a specialist to evaluate your options.